Book your online consulation now!

Mercury and Allianz Pension Partners GmbH

Two solid partners for securing your future

Key aspects at a glance

Take advantage of these deals from Mercury to secure your future and and enjoy a world of advantages.

You're at the heart of everything we do – that’s why we provide tailored solutions with exclusive terms just for you.

You’ll receive expert support and guidance from the experienced team at our trusted partner, Allianz Pension Partners GmbH.

The occupational pension scheme

Don't miss out on your contribution: Mercury will pay an employer’s contribution of up to 5 % of your basic salary, provided you make a personal contribution in the same amount. High savings contribution with low own burden!

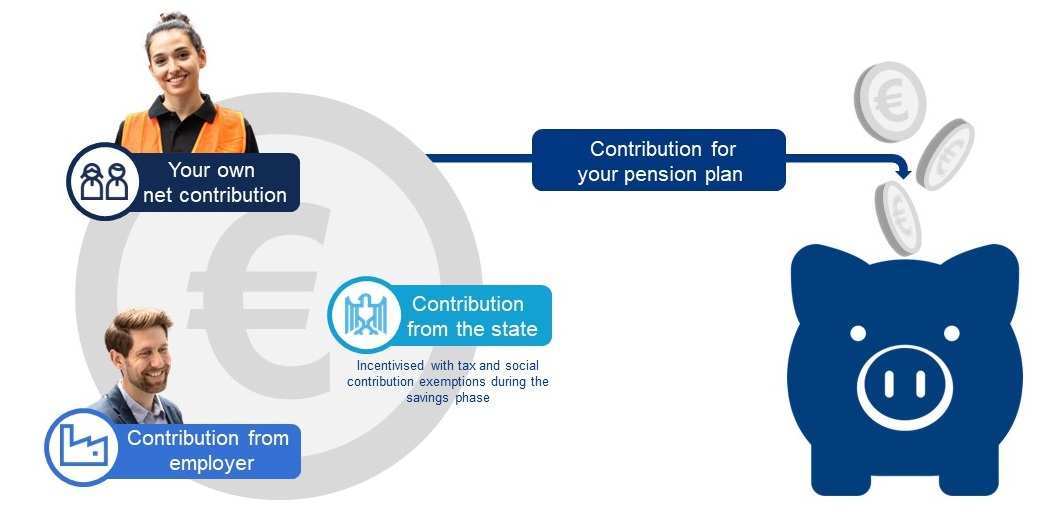

How the occupational pension scheme works

How your occupational pension is paid out:

How your occupational pension is paid out: You are required to pay tax and social security contributions on future benefits. Remember that your tax rate during retirement will usually be lower than what you have paid during your active working life.

Video: Learn more about the occupational pension plan

Company pension scheme

Your supplementary pension cushion incentivised by the state and your employer.

Financial boost from Mercury: An employer's contribution of up to 5% of your basic salary!

What you should know about the company pension plan

Wherever you choose to enjoy your future retirement, the statutory pension alone will be insufficient. The Mercury Pension Plan can make a key contribution to ensuring you can have a financially care-free retirement.

Close your pension gap – maintaining your standard of living in old age. Enjoy a care-free retirement.

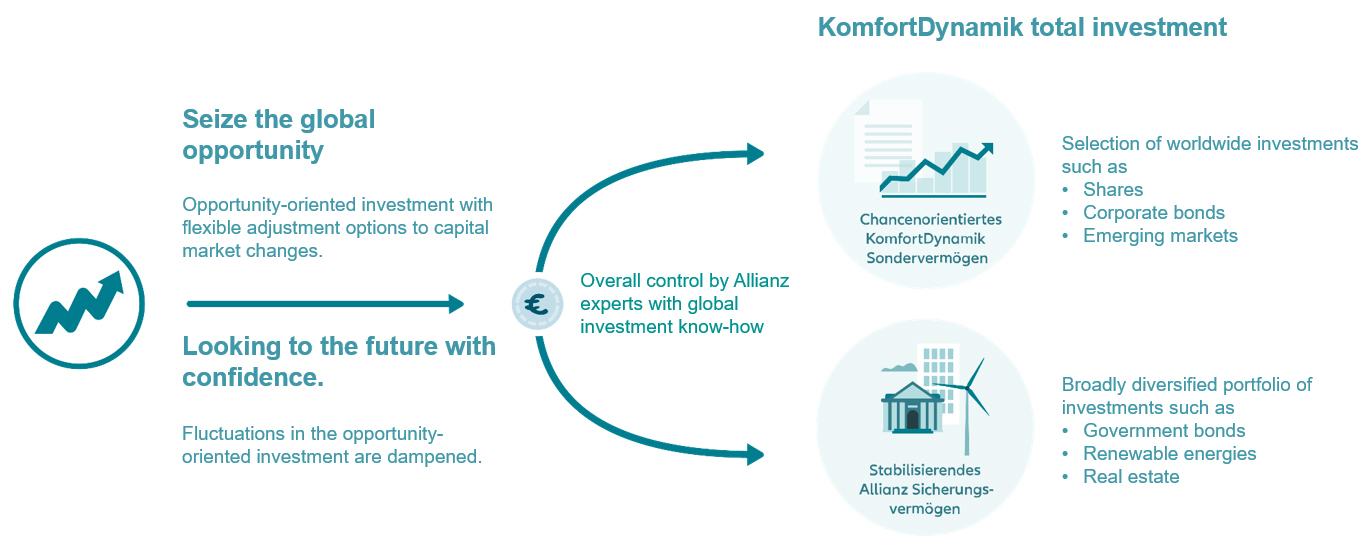

Capital investment option: KomfortDynamik – opportunistic

You can select between an opportunistic and a conservative pension plan concept.

At a glance: "Komfort Dynamik" – opportunity-focussed and convenient

Capital investment option: Perspektive – conservative

You can select between an opportunistic and a conservative pension plan concept.

At a glance: "Perspektive" – stable and secure

Occupational disability

What you should know about occupational disability

Your health is priceless! For most people their ability to work is the fundamental basis for earning an income. If you are unable to work over the long-term, the cover provided by the state will not be enough for you.

Are you covered?

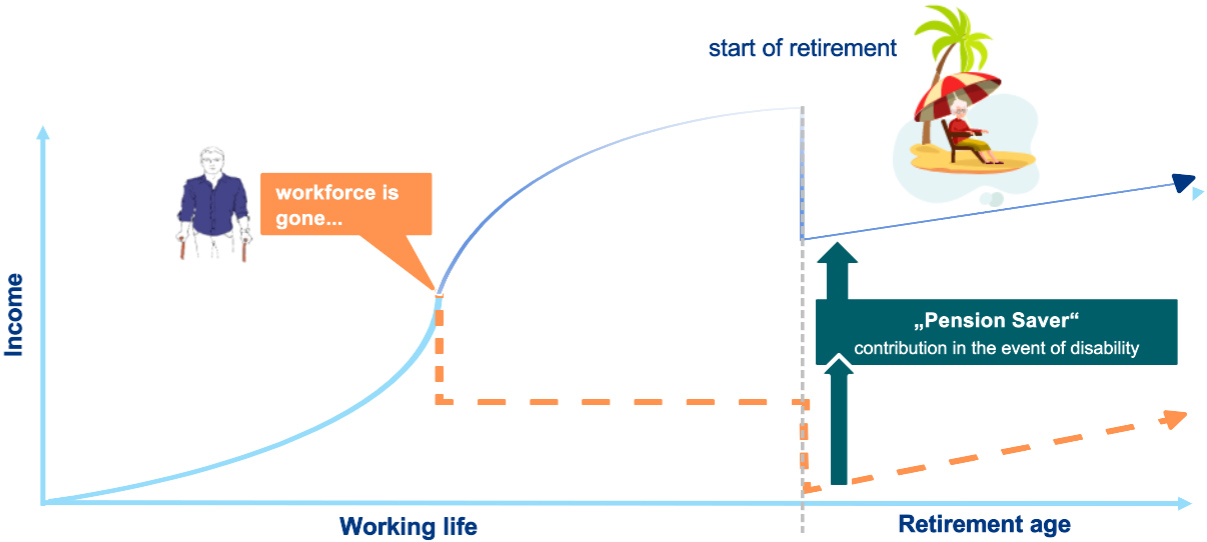

additional module "Pension Saver"

Occupationally disabled – yet continue saving for additional deferred compensation.

If you are no longer able to work – what then happens to the company pension plan into which you are supposed to pay contributions for many years to come?

A reduced income frequently makes it impossible to pay the full contribution into a retirement pension plan. The future old-age pension can then become reduced significantly.

- As an additional option, the "Pension Saver" provides cover for your pension plan contributions.

- Allianz will automatically assume payment of your contributions in the event of occupational disability.

- This means that you will retain the full amount of your old-age pension under the existing policy.

Advantages for employees

Arrange an appointment now

The team of experts from Allianz Pension Partners is happy to provide you with advice on your pension savings scheme.

Select your preferred date for an online consultation or a consultation on site at the company from the calender.

Get in touch

Our advisory team is here for you. You are welcome to schedule an appointment for a consultation or contact us by phone.